1. What does Accrual Accounting mean?

Accrual accounting is a fundamental concept in finance and accounting that helps businesses keep track of their financial transactions in a more accurate and comprehensive way than other accounting methods like cash accounting. At its core, accrual accounting is about recognizing revenue and expenses when they are earned or incurred, rather than when the cash actually changes hands.

Here are a few ways to understand accrual accounting:

- Recording Transactions in Real-Time: Accrual accounting records transactions when they happen, not necessarily when money is exchanged. This means that even if you haven't received or paid money yet, the financial event is still documented.

- Matching Income and Expenses: Accrual accounting ensures that revenue and expenses are matched in the same accounting period, giving a more realistic picture of a company's financial health.

- Accrual vs. Cash: In contrast to cash accounting, where transactions are recorded when cash is received or paid, accrual accounting provides a more accurate representation of a company's financial position.

2. Why is Accrual Accounting important to businesses?

Accrual accounting plays a crucial role in the financial management of businesses for several reasons:

Accurate Financial Reporting: Accrual accounting provides a more accurate reflection of a company's financial performance because it records transactions when they occur, not just when cash changes hands. This allows for better decision-making.

- Compliance with Accounting Standards: Many regulatory bodies and accounting standards require businesses to use accrual accounting to ensure consistency and transparency in financial reporting.

- Long-Term Planning: Accrual accounting helps businesses plan for the future by showing the full financial picture, including future income and expenses.

- Investor Confidence: Investors and stakeholders often prefer accrual-based financial statements because they provide a more complete understanding of a company's financial health.

3. Who should care about Accrual Accounting?

Accrual accounting matters to a wide range of people and entities, including:

- Business Owners: They need accrual accounting to understand their company's true financial position and make informed decisions.

- Investors: Investors rely on accrual-based financial statements to assess the financial health and performance of companies they invest in.

- Accountants and Finance Professionals: Professionals in the accounting and finance fields must be well-versed in accrual accounting principles to provide accurate financial information.

4. Risks associated with Accrual Accounting

While accrual accounting offers many benefits, it's important to be aware of potential risks, such as:

- Complexity: Accrual accounting can be more complex than cash accounting, requiring a solid understanding of accounting principles.

- Timing Issues: If not done accurately, accrual accounting may lead to misjudging a company's financial position.

- Management Manipulation: In some cases, businesses may use accrual accounting to manipulate their financial statements to their advantage, which can be misleading.

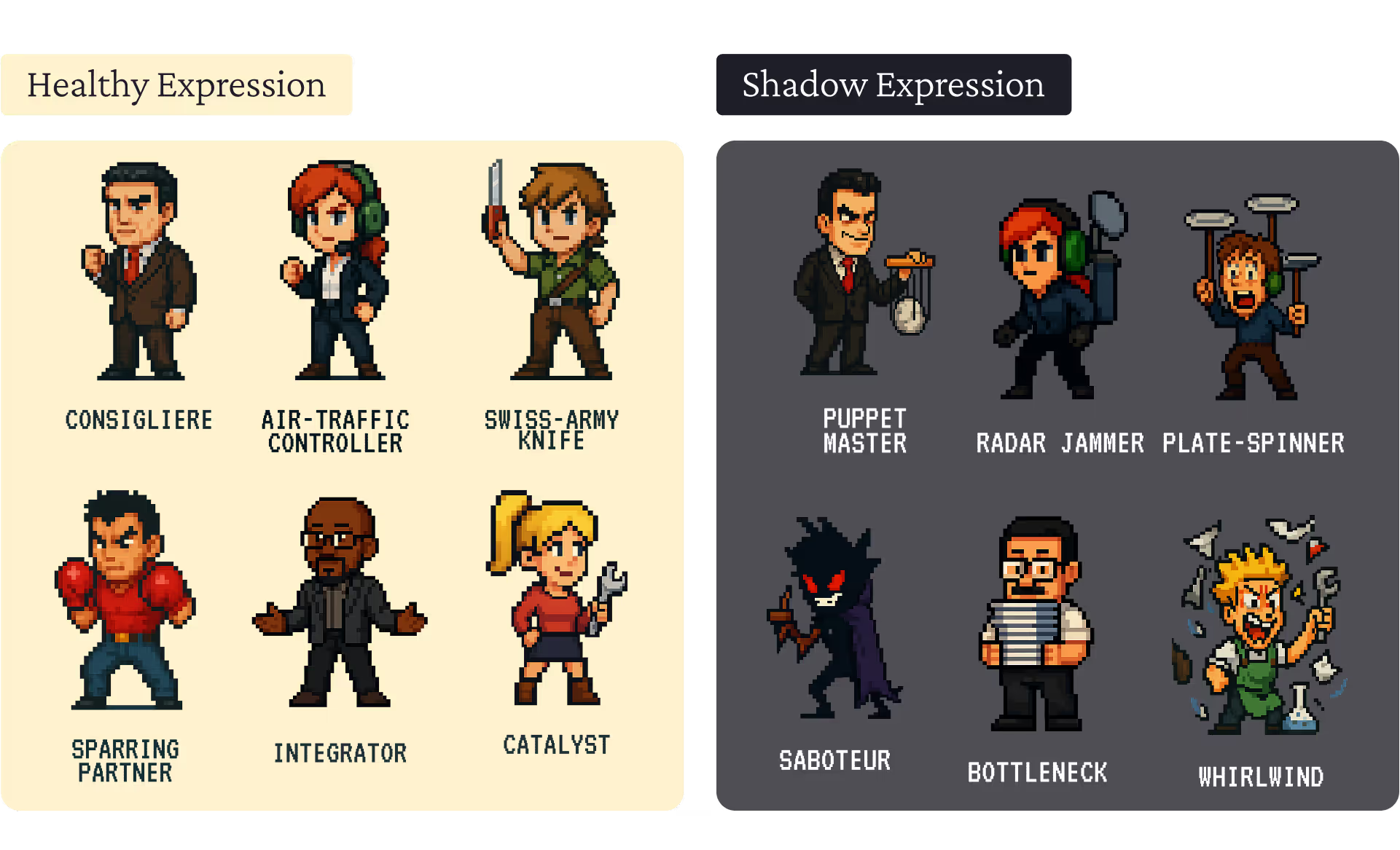

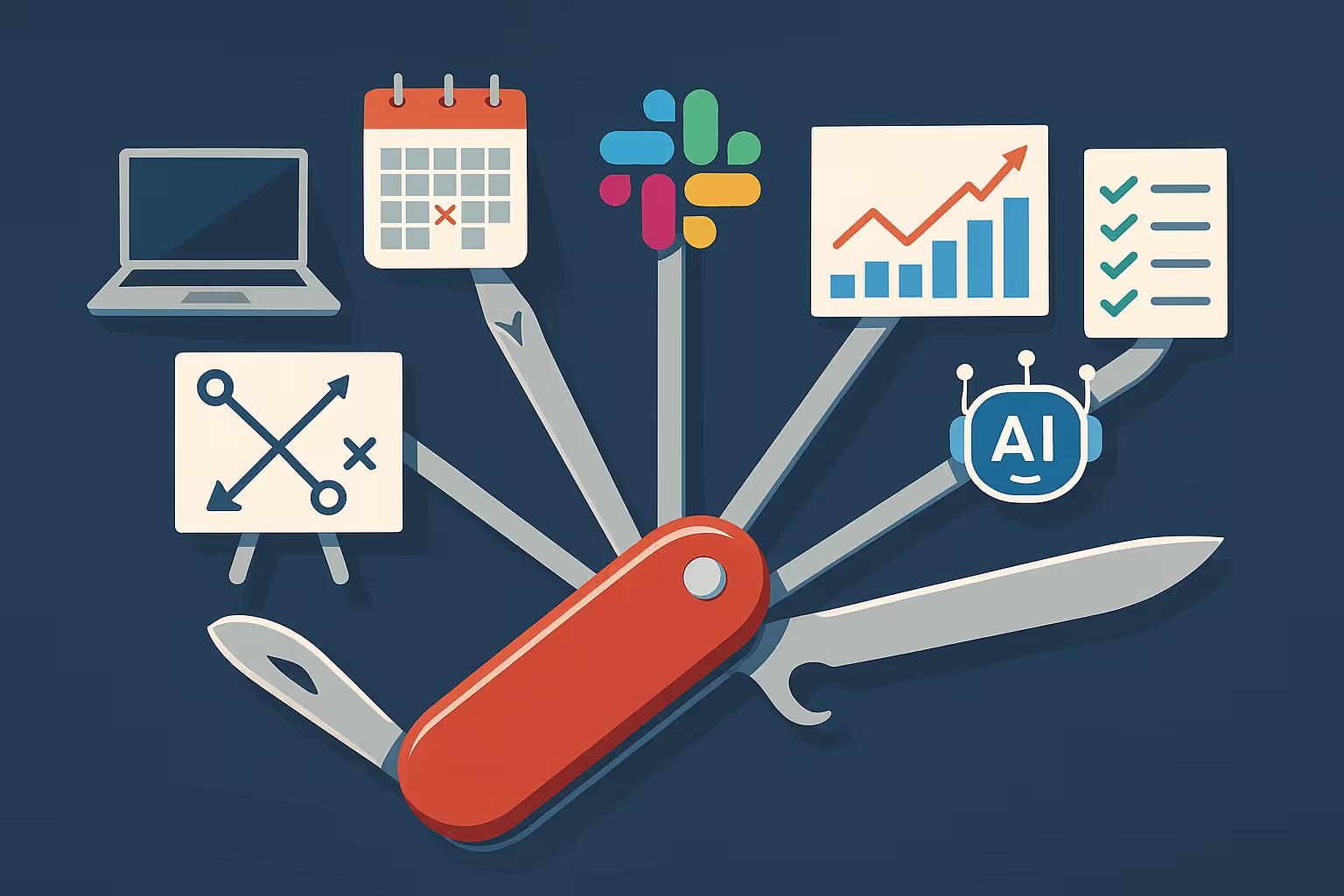

5. How is Accrual Accounting relevant to Chiefs of Staff?

Chiefs of Staff play a vital role in supporting top-level executives and ensuring the smooth operation of a company. Accrual accounting is relevant to them in several ways:

- Financial Decision Support: Chiefs of Staff often provide financial insights to executives, and a deep understanding of accrual accounting helps in offering accurate advice.

- Strategic Planning: Accrual accounting data is essential for long-term strategic planning, which Chiefs of Staff are actively involved in.

- Risk Management: By understanding the risks associated with accrual accounting, Chiefs of Staff can help executives make informed decisions and mitigate potential issues.

6. Online resources to learn more about Accrual Accounting

For those who want to delve deeper into the world of accrual accounting, there's an online resource available:

Investopedia - Accrual Accounting

Accounting Coach - Accrual Accounting

Khan Academy - Accrual vs. Cash Accounting

In conclusion, accrual accounting is a foundational concept in finance and accounting that plays a critical role in helping businesses maintain accurate financial records, make informed decisions, and comply with accounting standards. Whether you're a business owner, investor, or finance professional, understanding accrual accounting is essential for effective financial management and decision-making.

.avif)

.avif)